Contact Us

If you’re seeking ways to invest in leadership teams or require the expertise, guidance and support of a strategic-led implementation partner, then contact us today and a member of our team will be in touch soon.

January 23rd, 2025

.png)

Patrick Jones and Adam Woolley

As PE-backed tech companies double down on organic growth, a refined go-to-market strategy - and the right leaders to deliver - are vital for reaching, converting, and maximising the right customers, to drive profits, and returns.

Rachel Reeves’ inflationary Budget confirmed that the high interest rate economy is bedded in for a while longer. For private equity firms, that means value creation, rather than financial engineering, continues to be the route to growth. Our latest insights report, Leadership Capital 2024, shows the influence of leverage and multiple expansion has fallen significantly since the pandemic, while the role of margin improvement has doubled. More than ever, businesses must focus on the fundamentals of sustainable growth, looking deeper than top-level figures.

In the tech space, honing go-to-market strategies is vital to drive metrics such as new customer acquisition, gross revenue retention, and upsell. Investors want to see structures and strategies to sustain growth despite a tougher economy. A powerful demand generation engine and top-class customer success function are non-negotiable in today’s market, but in many cases, they aren’t delivering as they should.

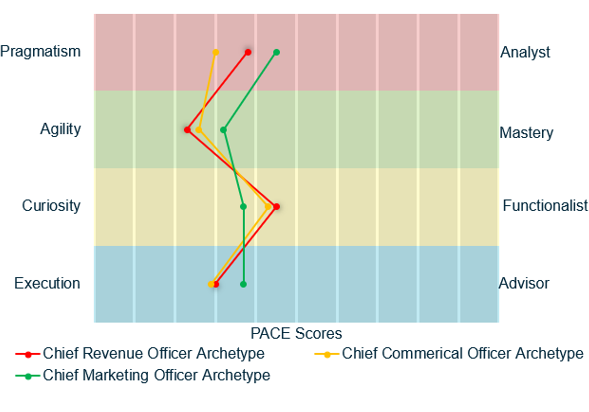

This is playing out in increased demand for revenue, marketing, and sales leaders, however, companies must understand what they need from their go-to-market leaders, before making a hire. The default is often to hire a Chief Revenue Officer, which may not always be the right choice.

It starts with data

Data and insights are the foundation of a successful go-to-market strategy. By applying a forensic approach to data quality, businesses can identify potential leaks in their revenue capture process. Excellent top-of-funnel acquisition metrics cannot outperform unhealthy gross retention rates, and vice versa, even the most efficient upsell machine needs new customers to drive sustainable growth.

Investors are laser-focused on data to identify assets with resilient business models, sticky products, and a consistent growth trajectory, and then track their success post-deal. As a result, the demand for data-native CROs is on the rise. Tech stacks and visualisation tools only go part of the way to early identification and diagnosis of issues. Human oversight is still vital to ensure quality data and analysis is at the core. The most effective CROs are proactively building a culture that values and prioritises data integrity by building the right skills in the team, regular opportunities for training, and sharing best practice.

Aligning people with strategy

Having a data-led culture provides clarity over customer acquisition, sales cycle economics, and post-sale demands. From there, companies have the insights to drive decision-making and pivot organisational structures, people, and leadership to deliver.

So, if a business is looking to drive inbound sales, alignment between demand generation and business development teams is critical to ensure a high cadence of marketing leads can be seamlessly converted. Or where the focus is on growing wallet share amongst existing customers, customer success and account management teams should be optimised for upselling and cross-selling.

When making leadership hires, achieving behavioural alignment with the demands of the role and the wider team is also critical. Revenue-generating leaders are diverse in their experiences and skill sets, so appointing the right or wrong person can have an outsized impact. Finding leaders with sales experience alongside the required people management skills is critical to building a cohesive team. Leadership analytics tools such as Leadership Dynamics can help ensure executives have the right blend of functional alignment, team complementarity, domain, and situational competencies to help guarantee a successful hire.

Let your business model influence leadership hires

Ultimately, there is no right or wrong way to structure GTM leadership, and hires should be led, first and foremost, by the business model. Take a B2C business - they will naturally need to invest more in marketing leaders to drive customer acquisition. In contrast, enterprise B2B businesses can vary widely in their GTM strategy. For example a business that primarily sells through a partner network is likely to need a CRO who is akin to a Chief Partnerships Officer, however, where direct sales is the main focus, the CRO will likely head up both a sales team and marketing function. Hence, job titles are often a poor indicator of a candidate’s suitability for a role, while analysis of their background (such as the nature of customer acquisition they have exposure to) and competencies is a far better predictor of future success.

Getting down to business

With the Budget at least providing clarity over economic pressures, and with the fresh energy a new calendar year brings, tech private equity firms and their portfolio companies can now be decisive. Consumer and business spending habits have evolved in recent years alongside the economy. Rethinking revenue models, go-to-market strategy, and the leadership in place to deliver them, is the safest way to deliver outsized investment returns.

If any of the themes in this article resonate with you and you would like to discuss them further please get in touch. You can email Patrick here or Adam here.

If you’re seeking ways to invest in leadership teams or require the expertise, guidance and support of a strategic-led implementation partner, then contact us today and a member of our team will be in touch soon.

Apply now and a member of our team will be in touch shortly.